The Only Guide for Jc Lee Realtor

Table of ContentsNot known Factual Statements About Jc Lee Realtor Jc Lee Realtor for DummiesJc Lee Realtor for BeginnersThe smart Trick of Jc Lee Realtor That Nobody is Talking AboutJc Lee Realtor Can Be Fun For Anyone

You may additionally have a hard time to locate sufficient lessees to fill that office complex or retail facility you acquired. Home Flipping Investors that wish to make money swiftly commonly resort to home turning. This is when you purchase a home for a reduced price, renovate it promptly and after that offer it for a fast profit.You're not interested in monthly leas when turning a house. Rather, you need to purchase a house for the cheapest possible rate if you desire to make a good revenue when offering.

Expanding your financial investment portfolio is essential. If you put all your eggs in one basket, you could experience an overall loss in the blink of an eye. When you invest some funds in the stock market, various other funds in bonds or ETFs, and also some in real estate, you boost your opportunities of higher earnings as well as less losses.

Neither is accurate, as well as to comfort you, right here are eight great factors why realty is a great investment. The Top Reasons Property Is an Excellent Investment If you're considering buying actual estate, you will start among the ideal financial investment trips of your lifetime.

The 15-Second Trick For Jc Lee Realtor

There aren't a lot of various other financial investments that enable you to buy properties worth far more than you have to spend. If you have $10,000 to spend in the supply market, you can typically acquire just $10,000 well worth of stock. The exception is if you buy margin (borrow), however you should be an accredited investor with a high total assets to make that happen.

Let's state you discovered a residence for $100,000; if you put down $10,000, possibilities are you could locate a loan to finance the remainder as long as you have good credit and also secure income (jc lee realtor). With that said, it indicates you invest simply 10% of the possession's value as well as have it.

Unlike stocks or bonds, you can require the real estate to appreciate. On standard, genuine estate values 3% 5% a year without you doing anything except maintaining the house.

/real-estate-investing-101-357985-final-5bdb4da04cedfd0026ac6b3f.png)

The Jc Lee Realtor Ideas

But, while it's an investment, when you own a home as well as lease it out, you run a company you are the property owner. As business owner, you can often write off the adhering to costs: The home mortgage passion paid on the financing Origination points paid on the finance Upkeep costs Depreciation (expanded over 27.

When you purchase supplies or bonds, you can just cross out any type of capital losses if you offer the possession for less than you paid for it. If you acquire and hold genuine estate, you can earn month-to-month capital leasing it out, and also this boosts the revenues from owning realty because you aren't counting only on the recognition but the month-to-month rental earnings.

Roofstock Industry is a read review fantastic source. They not only checklist offered investment residences up for sale, however numerous of them have tenants with leases in area already. When you buy the house, you instantly come to be a landlord. Roofstock also provides lots of due persistance, investigating you, so all you need to do is get the home you believe is best.

Without danger, there can not be a reward. There's not much to really feel safe concerning when you invest in the marketplace. However, as 2020 revealed, it can transform in the blink of an eye. One min you have a substantial investment, as well as the next, you've shed every little thing. When you buy property long-lasting, you understand you have a valuing property.

An Unbiased View of Jc Lee Realtor

If purchasing realty and leasing it out is as well demanding for you, there are many other ways to purchase realty, including: Buy an underestimated building, repair it up as well as flip it (solution and also flip) Be a dealer functioning as the middle guy in between motivated vendors and also a network of buyers - jc lee realtor.

Invest in a Genuine Estate Investment Company If you wish to leave a heritage behind but do not believe going money is a great idea, passing realty down can be even much better. Not just will you provide your beneficiaries an income-producing property, however it's also an appreciating property. So they can either keep the residential or commercial property and allow the legacy proceed or offer it and also earn revenues.

Let's claim you have $50,000 equity in a house. You can refinance the mortgage on it, secure the $50,000, and utilize it as a deposit on your next property. Depending on the value of your residential or commercial properties, you might also be able to pay cash for future residential or commercial properties, raising your profile as well as the equity in it even faster.

The Basic Principles Of Jc Lee Realtor

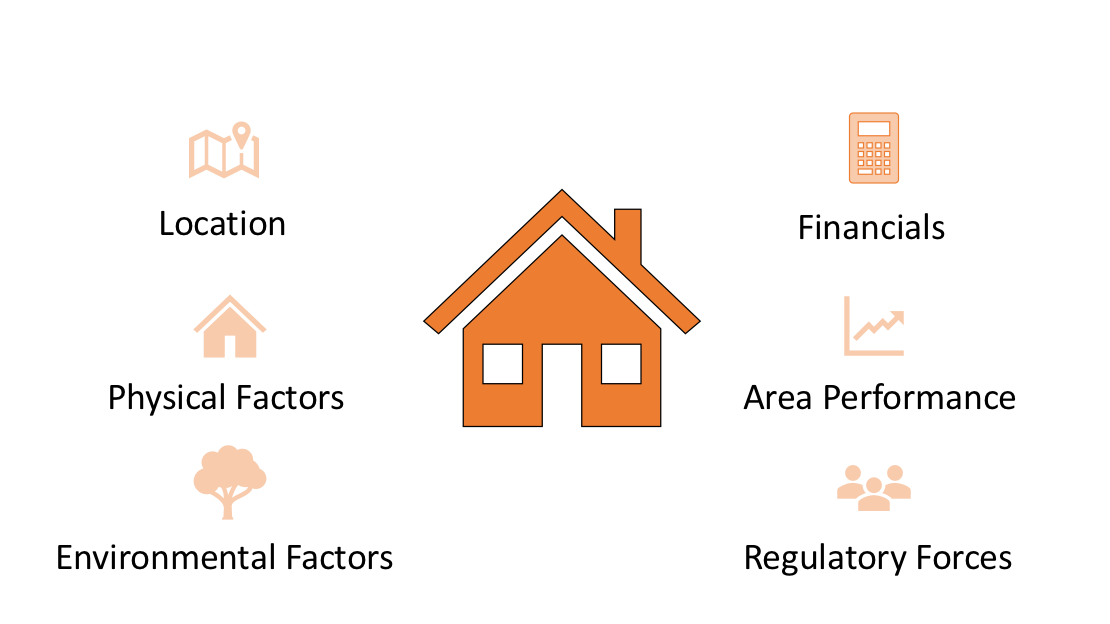

While there's not a one-size-fits-all solution, there are particular characteristics to search for when you buy real estate, including: Look for a location that's eye-catching for occupants or with quick appreciating homes. Make sure the area has all the facilities and conveniences most homeowners desire Check out the location's criminal offense rate, college rankings, as well as tax history.